A virtual journey on the new 3D printed silk road to Cathay, in Marco Polo's footsteps

Stay up to date with everything that is happening in the wonderful world of AM via our LinkedIn community.

Obtaining information and interacting with Chinese 3D printing companies is no easy task. The way we do business and the way we communicate in most Western countries are often so different and the language barrier does not help. However, that is also what makes Chinese 3D printing companies so interesting and fascinating. Over the past five years, China went from a very marginal presence in the AM industry to a leading nation, with dozens of companies producing (and increasingly exporting) hardware systems and hundreds of companies using AM for prototyping, tooling and actual final parts production all over China.

A common stereotype is that Chinese 3D printing companies don’t innovate, rather they take existing technologies and make them available at lower costs through economies of scale. Apart from the fact that this would already be quite an achievement in 3D printing in and of itself, it is far from being the entire story. In fact, Chinese 3D printing companies continue to improve on technologies and register new patents, leveraging often unique know-how in materials, robotics, mechanics and engineering. Perhaps more importantly, they also use them a lot. We often joke around that, in AM, Europeans tend to highlight everything that is not yet working to perfection; Americans tend to highlight the fact that everything is working to perfection while Chinese don’t highlight anything and just put the technology to work.

The Chinese presence in today’s AM market spans multiple segments. One is the entry-level 3D printer segment, where Chinese companies have been able to now offer ultra-affordable systems for both filament extrusion and LED photopolymerization, with the added benefit for the entire global AM industry of enabling an unprecedented number of people to enter the world of 3D printing. The next level is production capabilities: there are now service facilities in China that house more than 100 industrial machines, either SLA (laser stereolithography) or SLM (L-PBF) and do serious parts production for the domestic market. Then there are those Chinese 3D printing companies that have begun to build their presence abroad, offering increasingly competitive machines. Let’s take a look at some of the most important ones.

All 3D printing companies are based on the more industrialized Pacific Coast of China. The positions of the companies’ logos on the map do not reflect the exact location; they are meant to indicate the approximate geographic area of each company’s HQ.

Dominating the desktop

Where is China dominating in the AM industry? Desktop 3D printers are certainly a big part of it. Not so long ago, our friends at Nanji Xiong, China’s leading 3D printing news website, organized a conference with leading Chinese 3D printing market operators and reported that as much as 70% of the desktop 3D printing market is now controlled by Chinese manufacturers. Who are they? Let’s take a look.

1 – Creality 3D

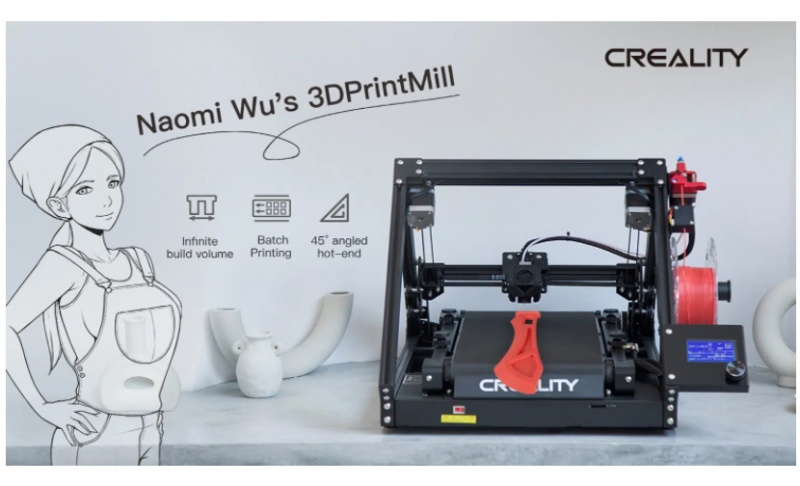

With the ultra-successful Ender series of 3D printers, Creality became the leading manufacturer of entry-level filament extrusion systems worldwide. Founded in 2014, the company grew rapidly from a four people workshop to over 550 employees. Besides extrusion systems, Creality also markets DLP/SLA light curing printers, 3D scanners, 3D viewers and 3D printing filaments. In 2021, Creality also launched the ambitious Creality 3DPrintMill(CR-30)project together with celebrity maker Naomi Wu, an infinite-Z volume 3D printer building on the work of Karl Brown and Bill Steele.

2 – AnyCubic

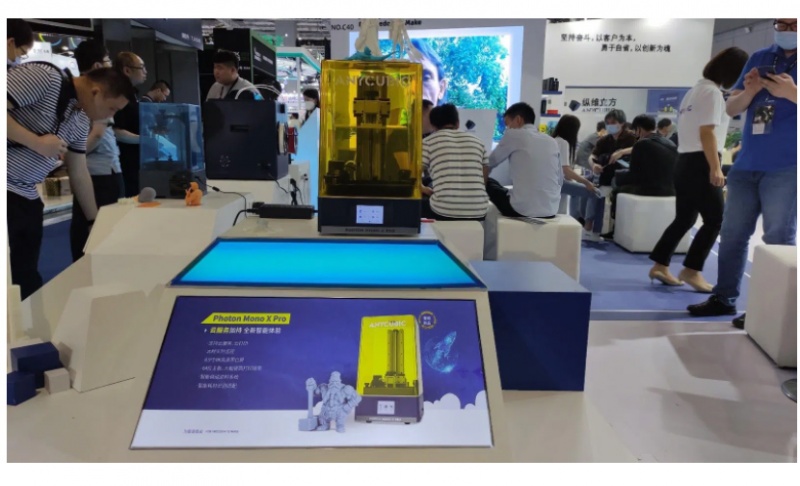

Founded in 2015, Shenzhen-based Anycubic is one of the most credible competitors for entry-level market dominance, with a team that has now grown to over 300 employees. Unlike Creality, Anycubic owes its popularity to the price and quality of its Photon LED stereolithography line of resin 3D printers, which truly made high-resolution printing accessible to everyone. Like Creality, Anycubic also manufacturers and markets other types of products, including the Vyper line of filament extrusion systems. Not content, the company also ventured in the more advanced DLP segment, with the recent launch of the Anycubic Photon Ultra.

3 – FlashForge

With its first Creator and Dreamer printers dating back to 2011, FlashForge is one of the “founding fathers” of Chinese 3D printing and of desktop 3D printing in general. The company’s core systems are positioned in a generally higher tier compared to both Creality and Anycubic, with professional-level machines (both extrusion and photopolymerization) costing in the order of a few to several thousand (FlashForge now even offers a material jetting system for the production of wax patterns) and the lowest-priced, consumer-targeted systems costing a few hundred. Recently FlashForge also ventured in the ultra-low-cost segment with the new Voxelab sub-brand.

4 – TierTime

Founded back in 2003, to study 3D printing technologies, by Allen Guo and schoolmates from Tsinghua University, TierTime is one of the most fascinating stories in 3D printing, not just in China. It is also one of the first Chinese 3D printing companies to target and succeed in Western markets. TierTime’s first 3D printer, the UP Plus was launched in 2009, together with other systems that emerged from the RepRap project (like the first MakerBot, Ultimaker and Prusa), leveraging an independently developed, proprietary system. It featured stepper motors and 1.75mm filament for much finer control with a full metal body. It was a huge success for the time. Today TierTime is somewhat less popular as a brand as it used to be but continues to develop and market technically advanced systems such as the newest X5 with interchangeable build platforms for continuous 3D printing.

5 – INTAMSYS

The INTAMSYS FUNMAT PRO 610HT top of the line system

The INTAMSYS FUNMAT PRO 610HT top of the line system

With INTAMSYS we increasingly blur the lines between consumer, prosumer, professional and industrial 3D printers. The company, based in Pudong, the modern business district of Shanghai, describes itself as an industrial 3D printer manufacturer targeting industries such as consumer products, medical, oil & gas & aerospace. The name INTAMSYS is an abbreviation of INTelligent Additive Manufacturing SYStems) and its systems are reportedly in use at Honeywell, Jabil, Bosch, FLEX, Sabic, UK Atomic Energy Authority, TE Connectivity, Stanford University, Tsinghua University. This is due to the high-end machines’ ability to process high-performance plastics such as ULTEM, PEEK and PSU, making INTAMSYS the most technologically advanced Chinese filament extrusion company today (a segment where most Chinese 3D printing companies have been focusing on entry-level systems). In addition, INTAMSYS has already begun its expansion to western markets, opening an EMEA HQ in Germany and a US base in Minneapolis.

Mastering metal

But the desktop is only part of the full picture. Especially over the past two years, many Chinese manufacturers have significantly scaled up their metal 3D printing. Today there are Chinese 3D printing companies that can offer a lineup of dozens of systems, from compact machines priced around $100,000 to giant production systems with up to 10-lasers priced over $1 million (but still less than their European counterparts). European and American companies do invest more in innovation and reliability of their machines, however, Chinese companies are catching up and can leverage local 3D printing service providers—or we should probably call them AM Factories—that are now capable of running more than 200 machines in one facility.

6 – BLT

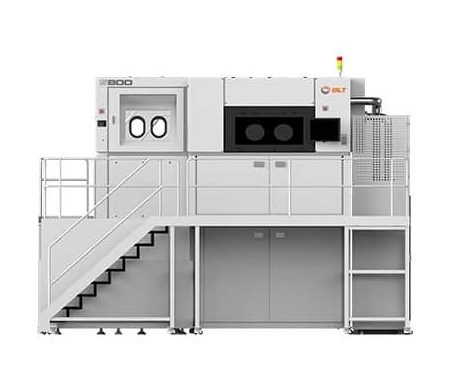

The 10-laser BLT S800

The 10-laser BLT S800

Founded in 2011, BLT is a pioneer for metal 3D printing in China and was also the first company to show an ability to compete with Western (especially German) industry leaders. The acronym stands for Bright Laser Technologies, which is the name it used to go by until it realized that the acronym worked better for marketing (although it’s not clear whether the management is aware that the company is now named as a popular sandwich). Either way, BLT is a giant of 3D printing by any standard, employing more than 1100 employees, of which 21.7% hold a master’s or above degree and 30.3% are R&D personnel. BLT invests over 10 million RMB (about $1.5 million) in R&D annually and is listed on SSE STAR Market since 2019. Much of BLT’s activity, however, is directed towards the internal Chinese market, where it’s likely to be the largest overall metal AM player. This impression is further reinforced by the fact that BLT is currently the only Chinese manufacturer to offer a 10-laser system, the BLT S800, which is the only machine in the world with more than 8 lasers besides SLM Solutions’ newest NXG XII 600 (and now also the new Sapphire XC from Velo3D). However hardware is not BLT’s only strength: among the biggest highlights of 2021, the company installed the 200th metal AM system for its internal metal AM service, making it the largest metal AM service provider in the world by number of units.

7 and 8 – Farsoon and Falcontech

Farsoon is one of the first Chinese industrial 3D printer manufacturers that took steps to expand in Western markets. The company, whose name is a portmanteau of the words “Far” and “Soon”, referring to its founder’s, Dr. Xu Xiaoshu’s, growth expectations, was founded in 2009 and was among the first in China to develop large size SLS 3D printers. Dr. Xu served as a technical director at the industry’s first SLS laser sintering company, DTM Corporation (now 3D Systems), in the early 1990s.

An array of 18+ Farsoon’s FS421M metal systems are installed at Falcontech Super AM Factory. Image courtesy: Falcontech

An array of 18+ Farsoon’s FS421M metal systems are installed at Falcontech Super AM Factory. Image courtesy: Falcontech

Farsoon’s expansion in Western markets began by forming a strong partnership with French 3D printing company Prodways in 2015. The French company, part of the large Group Gorgè, which is involved in nuclear energy and robotics at the highest levels, was already marketing a unique, large-format DLP technology called Movinglight and wanted to expand its offer with large size SLS 3D printers. Farsoon wanted to sell its SLS systems in Europe and did so through the “Prodways powered by Farsoon” brand. In 2021 the two companies officially parted ways and Farsoon has now established a direct presence in Europe (Germany) and North America (USA).

Unlike other Chinese industrial AM hardware companies such as BLT and HBD, Farsoon offers both polymer and metal 3D printing solutions, making it similar to Germany’s EOS in this approach. In August 2021, the company reported that the total installed base of its polymer and metal PBF 3D printers passed 500 units at customer sites. Such customers include leading Chinese AM service provider Falcontech, which is planning on installing 50 Farsoon 3D printers in its AM Factory, as well as a growing number of Western clients.

9 and 10 – EPlus3D and SHINING3D

The name EPlus3D (aka E-Plus-3D, EPLUS3D) is one of the latest ones in AM to reach Western shores, however, the company is not as young as it may seem. It was founded in 2014 and its core technical team has more than 25 years of AM technology experience, including MPBF™ (Metal Powder Bed Fusion), PPBF™ (Polymer Powder Bed Fusion) and stereolithography 3D technologies. Mr. Feng Tao, the founder of Eplus3D, presided over the development of China’s first selective laser sintering (SLS) equipment in 1993 and cooperated with South China University of Technology to develop China’s first selective laser melting (SLM) AM equipment in 2002.

The reason why most in the West have only recently heard this brand is that EPlus3D initially formed a partnership with 3D scanner specialist SHINING3D to market its systems in Europe and North America. The company provided the machines that were sold under the SHINING3D brand, similarly to Farsoon’s deal with Prodways. As of this year, Eplus3D parted ways amicably with SHINING3D and opened a new facility in Germany to market its systems directly. In China Eplus3D has two facilities in Beijing and Hangzhou, exporting machines to more than 40 countries, including regions in Europe, America, Japan, South Korea, and Southeast Asia. The company’s focus is on metal systems however its offer is competitive on SLS as well as large format SLA machines for parts mass production.

11 and 12 – HBD and Wenext

While it is also one of the newest names to emerge from China, HBD (Guangdong Hanbang 3D Tech Co) is a company focusing specifically on metal 3D printing hardware: as such it has developed a total of 23 models in large, medium and small sizes. Available HBD systems include multi-light path metal 3D printing large-size equipment measuring 600mm*600mm*1000mm, all the way up to the massive HBD-1500, introduced at the TCT Asia show in May 2021. The HBD-1500 metal additive manufacturing system has an extra-large fabrication size of 460x460x1500mm, one of the largest and widest in the market for metal PBF technology.

HBD also recently made headlines for signing some of the biggest sales deals ever in metal AM hardware. Earlier this year, the China Iron & Steel Research Institute Group – CISRI – completed the installation of 23 HBD metal 3D printers. These are mainly medium and large format machines, with plans to expand the fleet to a total of 150-200 metal 3D printers by 2025. Recently HBD also completed the one-time sale of 30 medium size HBD-350T systems to Wenext, a giant Chinese AM service provider with a current fleet of 1000 polymer 3D printers, and looking to establish a strong presence in metal AM production as well.

13 – ZRapid

Don’t let its position in this list fool you (companies are not listed in order of importance): ZRapid is one of the most interesting and relevant companies not only in China but in the entire global AM landscape. Its activities are still mostly focused on the domestic and Asian market but the company has already exhibited at shows in Europe (such as Formenxt) and will increase its exports eventually. Like other Chinese industrial 3D printing leaders listed above, ZRapid produces and markets both polymer and metal PBF systems. In addition, the company produces and markets a huge range of stereolithographic systems of all sizes (like many of the companies listed below).

What makes the company particularly interesting is that it also developed two proprietary technologies for processing various materials, including ceramics. The first, which it refers to as AMC (Additive Manufacturing for Ceramics), is actually a modification of its SLA capabilities to process ceramic paste materials, with an approach similar to the French global leader of this segment, 3DCeram. The second, which it refers to as FMS (likely an acronym that stands for Fused Material Sintering), is actually a hybrid of L-PBF and bound material technologies. The iFMS 400 system that implements this technology works by using a laser to sinter ceramic and metal powders that are coated by a polymeric binder material. The resulting green parts are subsequently sintered in a furnace as in other bound materials processes.

14 – Huake 3D

Many in the West became familiar with Wuhan only after it became identified as the initial epicenter of the ongoing COVID-19 pandemic. However, Wuhan, the capital of the Hubei region, is much more than that: it is one of China’s fastest-growing production and manufacturing technology hubs, with several Chinese 3D printing companies now based there. Most of these companies are focusing specifically on the domestic market, which is why many of them are not yet known in the West. That is likely to change and it’s good to prepare by knowing who they are: Wuhan Huake 3D Technology Co. Ltd (Huake 3D) is one of the most important ones.

With a registered capital amounting to 60 million USD, the largest such investment in the central part of China for an AM company, Huake 3D Technology Co. Ltd is a new high-tech enterprise which was established jointly by Huazhong University Of Science and Technology Industry Group, Huazhong NC and the Rapid Prototyping and Manufacturing Center of HUST.

Additively mass producing

Enabling metal AM for parts mass production is certainly a major focus for the Chinese AM industry today. At the same time, several Chinese 3D printing companies have already implemented mass production capabilities by focusing on consolidated polymers AM technologies, such as SLS and SLA. What is most striking is that many of these companies are able to achieve cost-efficiency by building large AM factories with multiple installed systems rather than incrementing machine productivity via new technologies (such as thermal polymer PBF processes like MJF from HP or layerless photopolymerization like DLS from Carbon). To date, no Chinese company has yet introduced a planar polymer PBF technology while only one Chinese, Luxcreo, company has so far introduced a layerless photopolymerization process, which is marketed primarily in Western markets.

15 – LuxCreo

Originating from China but also now solidly based in California, LuxCreo is the most credible Chinese competitor to Carbon’s high-speed photopolymerization technology for volume production. The company developed LEAP technology to simplify digital light processing, DLP, and achieve high printing speeds and production part performance, making customized volume production possible.

Unlike many other Chinese companies, LuxCreo pays a lot of attention to its image and English-language international communication activities, presenting an elegant and curated branding along with a solid technology. It provides fully integrated solutions – cloud-connected 3D printers, AI-enabled printing software, and advanced materials transforming the way businesses design and manufacture products in consumer, medical, dental, and industrial industries. Backed by Kleiner Perkins, LuxCreo is a privately held company with North American headquarters in the San Francisco Bay Area, and Asian headquarters in Beijing, China.

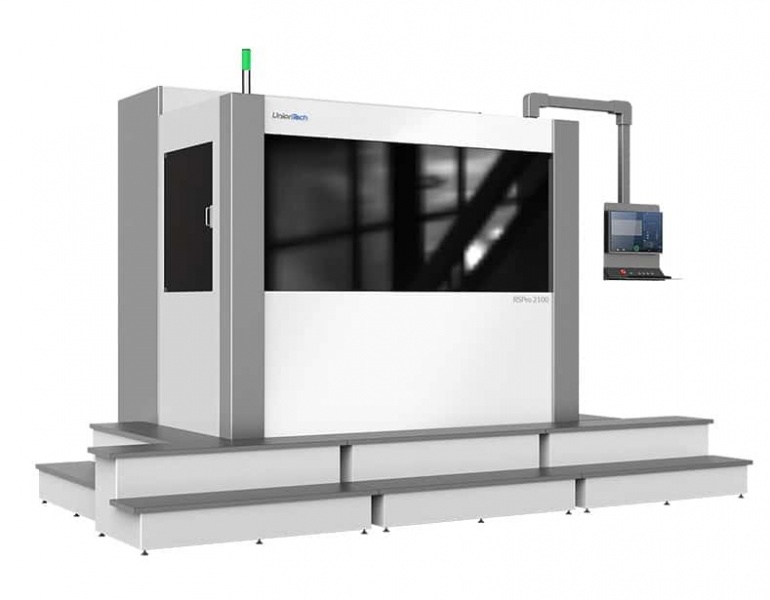

16 – UnionTech

With some 5500 industrial SLA 3D printers shipped and installed worldwide (mostly in China) to date, UnionTech is very likely, as the company claims, “the largest industrial stereolithography 3D printer manufacturer in China” and also one of the largest anywhere in the world. Founded in 2000, the company is one of the longest-established additive manufacturing (AM) operators in China. It registered revenues of 300 RMB (about 47 million USD) in 2019, up from 100 million RMB in 2015 and 200 million RMB in 2017.

UnionTech products include both large-format SLA systems (as large as 2100 mm) and DLP systems targeting dental applications primarily (mostly compact but also as large as 768 mm in width). In terms of global expansion, UnionTech did open a demonstration center in Chicago in 2018 however the company’s role may be even more relevant for bringing western products to the Chinese market. Over the past couple of years, UnionTech became an agent for Materialise software and DSM Somos (now Covestro) photopolymer resin materials, while also seeing Evonik Venture Capital acquire a minority stake in the company.

17 – Kings3D

While the company has only recently expanded westwards past Turkey (by signing its first distributor in Germany, Omnitec, last November), in China Kings 3D is emerging at the… king of additive production, at least concerning production of tools and final parts via stereolithography for huge consumer product segments such as footwear in particular. In fact, the company developed a unique know how and developed specific software to help footwear designers in China, the largest footwear production nation, create new products much faster and more cost-effectively.

This year the company completed a Series B financing of more than 100 million RMB (nearly $16 million USD). The investment was led by Rongyi Investment and jointly participated by multiple institutions including Jiafa Venture Capital, Jiafa No.1 Venture Capital, Furong Capital, Zhongwei Yihe Equity Investment Fund and Qingjue Capital. Furthermore, Kings’ existing shareholders Firstfortune Investment and SGT Capital continued to offer their support. This round of funds will be used by KINGS 3D on research and development of existing SLA 3D printing technology, and further development of metal 3D printing technology in dental, ceramic 3D printing technology, new materials and to build a global commercial network. The company also just inaugurated a large new HQ (in the images above).

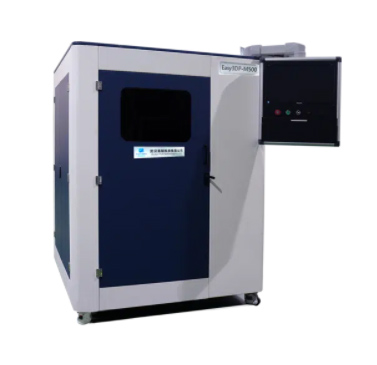

19 – EasyMFG

EasyMFG’s Easy3DP-M500 metal binder jetting system.

EasyMFG’s Easy3DP-M500 metal binder jetting system.

Could there not be a company in China that develops and offers binder jetting capabilities? In fact, there are several and EasyMFG (aka Wuhan Yizhi Technology) is probably the largest and best known, offering metal and sand binder jetting (similar to ExOne and voxeljet) and full-color binder jetting capabilities (like 3DSystems/ZCorp). The company began to develop full-color 3D printers in 2013 and made its debut in 2015, when it was named the “Most Innovative Enterprise” and “Top Ten Most Popular 3D Printing Companies in 2015” by the Chinese industry media.

The company’s main product lines are the high-speed production “Binder Jet Metal 3D Printing System”, “Sand Printer” and “Full Color 3D Printer”. The “Binder Jet Metal 3D Printing System” is the first such system produced and marketed in China, looking to compete with similar rising technologies from Desktop Metal, HP and GE Additive in a field that has been rated one of the top ten breakthrough technologies in the world in 2018 by the Massachusetts Institute of Technology Review. When the metal binder jetting takes off, EasyMFG will be a credible contender with systems already available such as the Easy3DP-M500, used mainly for automated tool production in industries such as shoe sole molds and faucets. In the meantime, the company is already selling numerous large-format sand binder jetting systems into the Chinese foundry industry

20 – Winsun

For a few years, Winsun was dominating the then very young construction 3D printing global market. In recent months the company has been quiet (possibly due to the recent troubles of the Chinese real estate market) and its feats have been overshadowed by rising stars in this increasingly crowded segment such as COBOD and ICON. Some would read into this that “you reap what you sow” since Winsun itself initially overshadowed the original inventors of these construction processes, companies such as Contour Crafting and D-Shape. Nevertheless, Shanghai-based Winsun (aka Yingchuang Building Technique) is a giant and a pioneer of concrete 3D printing, especially in the Chinese market.

The company was founded in 2003 and now holds 325 national patents, having been recognized for its key role in the “one belt one road” policy and for its impact on Chinese real estate. Over the years Winsun developed a series of new materials for its 3D printing technology, including mixtures such as GRG (glass fiber reinforced concrete), SRC (special glass fiber reinforced concrete), Crazy Magic Stone, and FRP. In 2020 the company reported that as many as 400 national landmark buildings have used its services and products, including the National Grand Theater, National Aquatics Center(Water Cube), Shanghai Expo Centre, Guangzhou Baiyun International Convention Center, Phoenix Media Beijing building, the APEC summit Lianxi Hotel, as well as the Dubai Government Office building and the Expo 2015 KIP Hotel in Milan.

Exploring new AM worlds

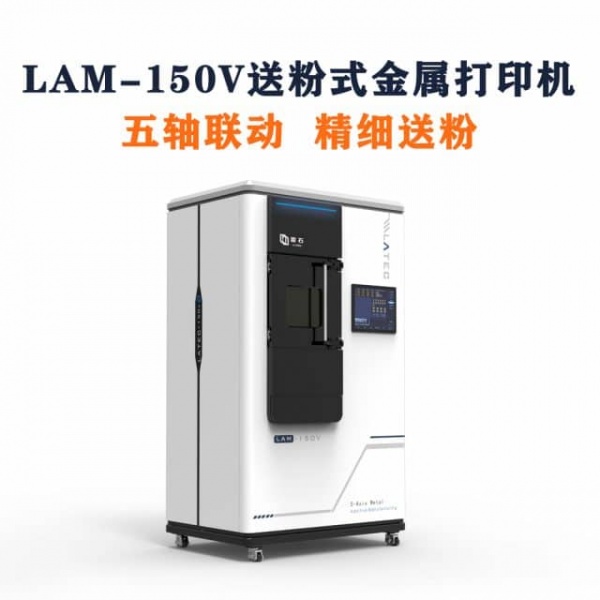

21 – Latec

While there are many large Chinese companies that we don’t yet have a large amount of verified information on, Latec is the opposite: an interesting startup that we know everything about since we were able to visit its facility in person in 2019. In many ways, Latec symbolizes the incredible possibilities that exist for young AM entrepreneurs in China. The company was founded in 2017 by Shuai HouTwo as a startup offering both DED and laser PBF metal 3D printers. Mr. Hou studied in the UK and spent time at the MTC, Britain’s Manufacturing Technology Center. After moving back to China he founded Latec, spent one year in an incubator, and within two years moved the company to a much larger facility to begin production.

Latec’s systems are customizable and can cost between $300,000, for the PBF and the smaller DED systems, and $500,000 for the larger Hybrid DED machines. Although it is still young, Latec has applied for over 10 patents and its systems are solid and efficient, leveraging current technology but making it more affordable and producing it on-demand to cater to the local market’s demand for tools (especially) and final parts.

Avtor Davide Sher