The year 2020 was an interesting 12 months for the additive manufacturing industry. It started with reaction to the loss of one its leading inventors, to responded admirably to the COVID-19 pandemic, there were then closures of businesses, reductions in workforces and goodwill impairment charges, and finally, a host of product launches and acquisition deals thrashed out towards the end of the year.

A glance at how 2021 is shaping up doesn't indicate that the pace is slowing down. In fact, there are a number of technologies, machines and software tools that will be made commercially available for the first time and a couple of mergers set to close.

Below, we speak to the companies who have big things planned for the year 2021, including GE Additive, Desktop Metal, HP, Wayland Additive, Hyperganic and more.

GE Additive Binder Jet Technology launch planned for 2021

“The motivation of this technology comes from the goal of making the production of game changing additive designs a reality.”

On the back of GE Additive’s H2 beta programme, which includes the likes of Cummins, Wabtec and Sandvik, the company is readying to launch a binder jet technology that moves the process forward and enables ‘high volume, low-cost additive production.’

The company is developing a technology that it hopes can challenge traditional manufacturing technologies like casting, machining and metal injection moulding, building parts as large as the size of a basketball, as well as smaller components, with material properties that at least match those of a cast equivalent.

“This platform is being utilised for application, process and material development,” Jake Brunsberg, Product Line Leader – Binder Jet, GE Additive told TCT. “We are working with early partners to scale maturity of the technology, specifically geared for application readiness towards mass production. The natural progression form this second phase of the [H2 beta] programme is our production line solution. This is planned to be launched in 2021 as part of the movement towards high volume, low-cost additive production.”

GE says it has placed a key focus on safety, high Overall Equipment Effectiveness (OEE), automation readiness, predictive distortion, compensation and material properties that meet or exceed industrial needs. It wants to enable the lowest total cost of ownership for metal additive production and, in doing so, open up opportunities around fuel efficiency, NOx reduction, electrification, novel fuel cells and package size reduction of subsystems in sectors like the transport industries.

Part of its method to eventually provide these capabilities to market was to set up the H2 beta programme, aligning the technology with companies that have industrial pedigree to ensure the tech was scalable. Through these partnerships, GE believes it has ensured its production lines will meet the requirements and expectations of their advanced production floors and will make ‘additive mass production a reality for our partners.’ Throughout 2021, the company expects to add more external partners.

“The motivation of this technology comes from the goal of making the production of game-changing additive designs at reality for low cost, high volume industries,” Brunsberg added. “We have partnered to support product innovation in the automotive and industrial sectors at scale. The ability to effectively produce a ‘mouldless casting’ will open product innovation in powertrain and chassis applications that further enable electrification, renewable energy technology, and efficiency of current ICE infrastructures. By partnering closely in these sectors, we are ensuring the technology aligns with real-world production expectations and requirements.”

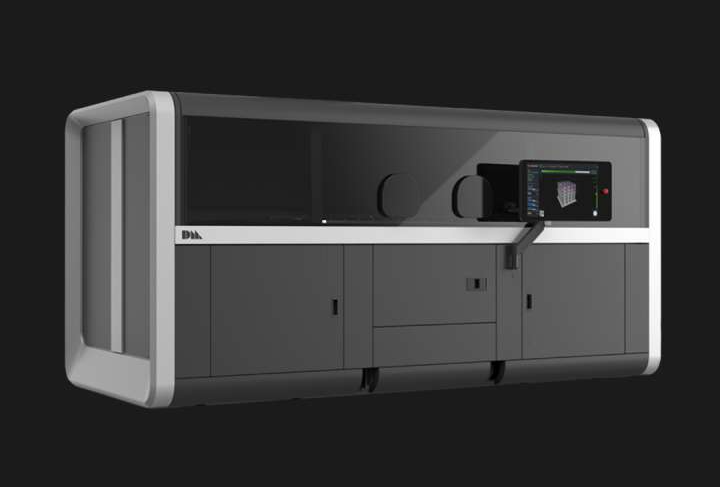

Desktop Metal to ship Production System in H2 of 2021

“It’s a great testament to the fact that volume production via additive is really turning a corner. Metal binder jetting has reached a significant level of maturity.”

Having come out of stealth in 2017 openly discussing its plans for a metal binder jet ‘Production System’, in 2021, Desktop Metal is now ready to begin shipping its machine designed to enable volume additive production.

The platform, renamed P-50 after the launch of the P-1 benchtop version earlier this month, has been working since on the feedback received by some key partners, who have been testing and validating the capabilities of the machine. With its Single Pass Jetting technology, Desktop Metal’s P-50 deposits, compacts and spreads powder, as well as deposits the binder, in a single carriage that prints bi-directional. It is said to be able to achieve print speeds of 12,000 CCs/ hour, build ‘tens of hundreds of thousands of parts or even millions a year’ and offer an economic part cost with a kilogram of 17-4 stainless steel said to cost ‘in the range of $50-60’.

With the P-50, Desktop Metal is not only hoping to penetrate the medical and aerospace fields, but also provide customers in the automotive, oil and gas and consumer goods sectors a cost-effective way to additively manufacture parts at volume. That it does so at a time many other companies are betting big on metal binder jetting technology speaks volumes, Desktop Metal’s VP of Product Arjun Aggarwal.

“I think it’s a great testament to the fact that volume production via additive is really turning a corner. [Metal binder jetting] technology has reached a significant level of maturity and we think we’ve got a great solution here that is market leading in terms of throughput, productivity, economics and technology that’s going to enable really repeatable, scalable mass production,” he told TCT.

Aggarwal believes that the recent launch of Desktop Metal’s Live Sinter platform is critical in achieving this. In conventional powder metallurgy industries, he says they have create a bit of an ‘art form’ in knowing how certain geometries will behave when put through a furnace, but the complexity 3D printing affords means users of AM need more support. With Live Sinter, users are able to simulate runs within a couple of minutes and have pre-deformed parts that compensate for what is going to happen inside the furnace within 20. Desktop Metal believes this will help companies reduce trial and error and reduce the time to first part success.

“Ultimately, sintering is quite literally a black box process,” Aggarwal said. “You put parts in, it’s really hard to observe what goes on inside and then you get the parts out. One of the benefits of 3D printing and binder jet specifically is you get a level of complexity that you may not have been able to achieve with conventional manufacturing. The problem with that is it’s whole new world of geometries that you have no idea how they’re going to sinter and what the parts are going to look like coming out. Even a little bit of distortion can be the difference between a part that meets your criteria on specs and accuracy and a part that doesn’t so it’s really important to have software that can help you understand what happens in the furnace.”

HP ‘on track’ to ship full-featured version of Metal Jet technology

“We’re doing things we used to think were impossible.”

HP Metal Jet machines.

Two years on from the initial announcement of HP’s Metal Jet technology, the company says it is on track to expand the availability of and ship a ‘more full-featured version of the Metal Jet solution’ in H2 2021.

HP has made the move into metal 3D printing as it wanted to replicate for customers in metals what it had ‘unlocked for customers with polymers.’ It is promising speed, quality, reliability and scale with its Metal Jet technology, while also assuring customers they will not need to sacrifice complexity nor a competitive cost per part.

While the technology was originally only available via the services of GKN and Parmatech – an offering that will remain – select customers are now said to be also be using the technology in-house. HP partnered with GKN and Parmatech for their metal powder and metal manufacturing proficiencies, allowing end-users to sample Metal Jet before investing further and also helping to develop applications, but had always slated 2021 as the year it would expand availability of the technology once it had proved itself capable of addressing customer requirements.

“With both companies, we’re addressing systemic manufacturing challenges where HP can provide a markedly differentiated solution,” Uday Yadati, the Global Head of HP’s Metal Jet Printing Business, told TCT. “One of those is the long-term design and production freedom that only 3D printing can provide. For example, partnering with GKN, HP has helped Volkswagen embed Metal Jet technology into its long-term production strategy for mass-customisable parts, and with Parmatech, we just recently helped Cobra Golf bring the world’s first 3D printed commercial putter to market. What the engineers at Cobra told us is that Metal Jet gave them a window into a completely different design philosophy – one where they don’t necessarily have to plan their next product years in advance. They can be more agile and responsive to the innovations happening in technology and in the sport of golf.”

By leveraging its own IP and expertise, as well as ‘investing in strategic partnerships’, HP intends to deliver ‘fully capable solutions’ to the likes of Cobra Golf, encompassing materials, software, sintering and post-processing. The company is said to be focusing on a range of industries, but has outlined consumer goods and automotive as two that ‘have already demonstrated a path to profound digital transformation.’ Within that, both sectors are taking a closer look at customisation, while there are other markets, like aerospace and defence, that want greater design freedom, to modernise their inventories and manufacture more sustainably. HP believes its Metal Jet offering can answer all of these wants and needs.

“Cobra Golf, Volkswagen, the U.S. Marine Corp or any number of the other customers we’re working with would likely share their own version of this: we’re doing things we used to think were impossible,” Yadati said. “They are experiencing new-found design freedom; they’re changing their business models and cutting costs because they no longer have to store massive volumes of parts; they’re seeing novel ways to connect with customers and offer them one-of-a-kind products; they’re also manufacturing more sustainably and efficiently. They aren’t just changing companies; they’re changing entire markets. The Cobra Golf team says the technology will revolutionise their sport [and[ a U.S. Marine Corps colonel described the efficiencies of Metal Jet as ‘astronomical’. It’s difficult to overstate the value of these transformative shifts.”

Wayland Additive to launch first NeuBeam product

“It’s about really having industrial standards for metal AM.”

Emphasising that it is not a me-too technology and is in fact a new technology with new capabilities that neutralises the issues of electron beam processes is Wayland Additive.

In January 2021, the company will launch its Calibur3 platform and NeuBeam technology that promises greater flexibility and stability, as well as the ability to process materials like tungsten, copper and tantalum. This technology, Wayland believes, will mean manufacturers no longer have to compromise in process or in materials when adopting and applying metal additive manufacturing.

One of the key capabilities of Wayland’s technology is its in-process monitoring capabilities, which yield backscatter data from an electronic microscope; map temperature across the bed and provides a visual representation thanks to high speed, infrared camera systems; and gives insight on the topology of the powder’s surface using white light scanning and cameras. This combination of technology gives the user the ability to monitor porosity, swelling, temperature changes, while also allowing them to alter the cooling the cycle, keep melt pools alive and change the structures of parts using the e-beam.

“It's about really having industrial standards for metal AM,” Wayland Additive’s Director of Business Development Pete Hansford told TCT. “Really, there aren't any today. And we were lucky that we started with a blank sheet of paper to develop our own in-process monitoring because we needed to see what was going on. Having that in-process monitoring allows you to monitor what you were doing and why you’re doing it. You want to have as much information to understand what you’re doing, so when you dial in and change your parameters, you want to see, cause and the true effect of that change.”

With capabilities like this, Wayland is ‘walking into the market’, where it plans to work with customers, develop a need and use for its NeuBeam technology and watch sales grow naturally. It also intends to make available larger systems than the Calibur3, which is equipped with a 450 x 450 x 450 mm build volume, though the platform to be launched next month will be ‘capable of being next-generation’ with Wayland wanting to make sure that customers don’t invest in a machine that is superseded months later.

These customers, Wayland expects from more of a year of engaging with industry, will start in industries like aerospace, medical, powder generation and the military, but in time, the company anticipates serving a broader range of users.

“Those have been the areas where we think our technology is applicable to in the first instance,” Hansford said, “but I think once it matures into a production process, then I’m sure that will open up, because the hard work will have been done by these pioneering industries who are looking to have an edge in technical capabilities.”

Evolve Additive prepares to ship SVP platform

“We are extremely proud of our revolutionary STEP technology.”

Twelve years after the company first began to work on its Selective Thermoplastic Electrophotographic Process (STEP) technology, Evolve Additive Solutions will next year begin to ship its Scalable Volume Production (SVP) system.

After securing its first order from an unnamed customer last month, Evolve is set to install the machine in Q1 of 2021. It has been described as a significant milestone in the technology’s commercialisation, with the company expecting STEP to have a big impact across a range of industries.

“We are extremely proud of our revolutionary STEP technology, that runs on our SVP platform, and know that it will streamline customer efficiencies, increase profits and provide them with visibility into the utilisation across their network,” Evolve co-founder and CEO Steve Chillscyzn told TCT. “Additionally, our partnerships with global organisations strengthens our portfolio to include software, materials, application and consulting services.”

The technology is said to have been brought to market to address the quality, materials, speed, scalability and cost efficiency requirements of a plethora of customers in an array of industries. Evolve is targeting markets such as aerospace and defence, dental And medical, packaging and consumer goods, and automotive, which it is suited to because of its ability to process 100% dense thermoplastics with isotropic properties, deliver multi-materials and multi-colour, custom blends at voxel level and complex geometries and fine features. Its capacity to print amorphous and semi-crystalline materials, metal plateable parts and embed electronics are also key features of STEP technology.

To supplement these capabilities, the company has moved to partner with PostProcess Technologies, Evonik and Siemens. PostProcess Technologies was selected to enable automated support removal of parts printed with STEP, while Evonik was chosen to develop several nylon materials using its ‘unique particle formation capabilities’ on a materials roadmap that also includes high impact ABS, PEBA and urethane thermoplastic elastomers, polypropylene and polyoxymethylene. Siemens, meanwhile, was selected for its Xcelerator portfolio, with Chillscyzn reasoning that the alliance will help Evolve enable customers to achieve volume additive production.

“This partnership equips our ground-breaking Scalable Volume Production platform with the software required to connect and automate an AM factory for full-speed, high-volume production. Our AM production machines can leverage Siemens Digital Industries Software AM solutions to prepare end-user parts for volume production, generate print jobs, manage production planning, drive execution on the factory floor and monitor the process in real-time.”

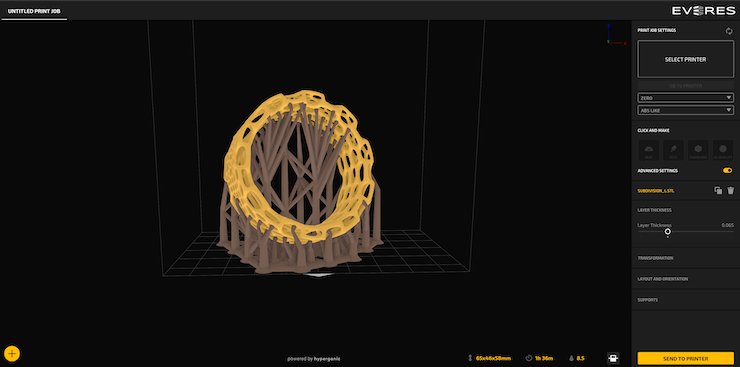

Hyperganic emerge from stealth with two product launches

“Automated print preparation and extremely precise process control are crucial for AM mass production.”

German software company Hyperganic will finally begin to talk more openly about its product portfolio as it releases the Hyperganic Core 2.0 and Hyperganic Print Framework 2.0 platforms.

After spending years in stealth mode, the company says it is ready to ‘turn heads’ with its advanced examples of computer-generated AM parts.

The second version of Hyperganic Core, its voxel-based geometry platform for AI-based and algorithmic design, will be released in the first half of 2021 and is described as the ‘foundation of the Hyperganic platform’. Hyperganic Core uses voxels at printer resolution or higher to represent geometry with ‘arbitrary complexity’, defining it through surface or parametric models, print clouds, implicit modelling or manipulating it through direct voxel access.

Its capabilities include a new programming model based on industry standard tools, new visualisation options and ‘significant performance enahncements’ on workstations and consumer hardware. Core 2.0 is available on desktop and as a scalable cloud application platform, and has been the subject of partnerships between Hyperganic and companies in medical and industrial markets.

“2021 will be an important year for Hyperganic,” Lin Kayser, co-founder and CEO of Hyperganic, told TCT. “We will release the second version of our Hyperganic Core platform to a much broader market. We have been working with our customers to build very sophisticated products, some of which are really aspirational. With Core 2.0, we are taking this to a completely new level, moving us closers to our vision of generating parts and even entire machines through algorithms and AI.”

Meanwhile, the Print Framework 2.0 platform is considered by Hyperganic to be the workhouse for print preparation and highly precise process control.

Its capabilities include mesh repair, slicing, support generation, nesting, stacking, voxel-level process control and multi-material support for extrusion-based systems and Stratasys’ family of multi-material platforms. There are also built-in lightweighting and texturing options, enhanced support structure generation for the medical and jewellery markets, and a ‘significant enhancement’ for FFF 3D printing, which includes gapless infill, anti-oozing, automatic arc detection and adaptive path rooting. The Print Framework 2.0 software will be available in Q1 of 2021.

“Automated print preparation and extremely precise process control are crucial for AM mass production,” Markus Finke, Director of Business Development at Hyperganic, said. “With the new release of the Hyperganic Print Framework, we offer a comprehensive solution for all printing processes, whether resin-based, extrusion or powder. Two parts stand out: multi-material support and extensive enhancements for challenging materials such as PEEK.”

Covestro set to complete takeover of DSM’s 3D printing business

“The partners along the value chain will profit from a merged expertise and know-how in the field of AM.”

As part of a $1.61 billion acquisition of its resins & Functional Materials business, Covestro is set to complete the takeover of DSM’s 3D printing offering in H1 of 2021.

The deal was struck not long after DSM had agreed to acquire a portion of Clariant’s 3D printing business and is said to form an important part of Covestro’s corporate strategy. It brings together what the company’s believe are complementary technologies and customer industries, as well as a shared commitment to sustainable product portfolios.

At the recent Formnext Connect event, Covestro’s presence was ‘entirely dedicated’ to the circular economy concept, focusing on materials products, like many in its Addigy brand, have a bio content of almost 50% or are made from recycled materials. Likewise, DSM was showcasing its EcoPaXX AM4001 material which is 42% bio-based according to ISO 16620-1 2015E and, the company believes, will help users lower their emissions and reduce their carbon footprint. As the two come together, they hope to continue developing materials that ‘drive innovation and advance sustainability’ across many industries.

Though neither company has wished to talk in detail about the transaction, the Head of Covestro’s Coatings, Adhesives, Specialties segment told TCT:

“DSM is a pioneer with decades of experience in the liquid resin development for additive manufacturing and we are now intending to join forces. The partners along the value chain will profit from a merged expertise and know-how in the field of additive manufacturing and the complementary product portfolio will expand solution offering for end users. The broader regional set-up will increase the access and speed to the market. In the context of innovation DSM’s additive manufacturing will be a good strategical fit and contributor to Covestro’s vision to become fully circular.”

Stratasys to finalise $100m acquisition of Origin

“We realised that the opportunity with Stratasys was incredible.”

Origin One platform.

Earlier this month, Stratasys announced an agreement to acquire Origin in a deal that could reach $100m. It is set to be completed in January 2021.

The merger between the two companies has been in the works throughout 2020, with Stratasys keen to expand its portfolio with the integration of Orogin’s Programmable PhotoPolymerization (P3) technology and Origin interested in exploiting Stratasys’ go-to-market engine.

P3 is a Digital Light Processing technology that has been packaged into the modular Origin One platform and is able to process a host of resin-based materials developed in partnership with the likes of BASF, DSM and Henkel. Origin has come to market in the last few years harnessing an open approach and a flexible business model that allows users to adopt the technology via a subscription model or through outright purchasing options. As Stratasys takes over the company, this is set to remain in place, with Stratasys even hinting that Origin’s approach may even inspire the buying company to evolve and modernise its approach.

Upon the closing of the deal early next year, Origin’s P3 technology will be shipped globally via a go-to-market engine that is comprised of 160 resellers, over 100 field service engineers and a range of vertical market-specific team that deal directly with leading manufacturers.

“This was an opportunity to leverage what I believe is the industry’s leading global go-to-market service and be in a place where we can continue to focus on the technology actually more intensively than we do today. Grow the team, grow the product and everything that we’re doing and really utilise that infrastructure without stepping on anybody’s toes,” Origin CEO Chris Prucha told TCT. “We realised that the opportunity with Stratasys was incredible. We don’t want to be acquired into a company and refocus on something else or to be grafted onto another technology. We have this world-class technology team, IP portfolio, software-driven architecture and we complement everything that Stratasys would need.”

“When customers think about 3D printing and where to go for 3D printing needs, we want them thinking Stratasys first,” Rich Garrity, Stratasys’ President of Americas, added. “That means having a breadth of technologies that we can answer the call on the right technology for the right application, providing a full solution to the customer.”

The full interview with Prucha and Garrity can be read here.