The consulting firm CONTEXT publishes a quarterly study on the additive manufacturing market, focusing on machine shipments across all product lines. This time around, the news from the report is positive, showing growth in orders and shipments, particularly in the segment of industrial 3D printers, i.e. solutions over $100,000. This is a very encouraging sign despite a very difficult global context: the slowdown of the Chinese economy due to COVID, the conflict in Ukraine, global inflation, etc. Furthermore, market players remain optimistic for the rest of 2022.

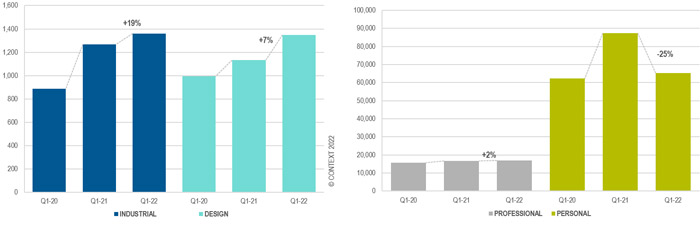

CONTEXT usually classifies 3D printers into four categories and looks at the number of shipments made – not to be confused with the number of sales made. These four categories are: industrial (+$100K), design (between $20K and $100K), professional (between $2.5K and $20K) and personal (less than $2.5K, excluding kit 3D printers). What is interesting to note in this new report is the growth of the “Design” and “Industrial” segments, respectively by 7% and 19% compared to the same period in 2021. Between them, they represent 69% of the total revenue for the quarter, proof that companies and users are looking to invest in more powerful solutions, offering better efficiency and productivity.

Shipments of so-called industrial and design 3D printers have increased compared to other segments (photo credits: CONTEXT)

Growth in the Industrial and Design Segments

Looking first at shipments of those in the category of “Design” 3D printers, i.e., between $20K and $100K, CONTEXT’s study states that the top 10 manufacturers offering this type of solution have all increased their shipment numbers. Of note is a significant increase for 3D Systems and Stratasys with their respective MultiJet and PolyJet technology. These material-jet processes offer users high detail and the ability to design colored and transparent parts. New players have also contributed to this growth such as Origin, recently acquired by Stratasys, and Kumovis, now owned by 3D Systems.

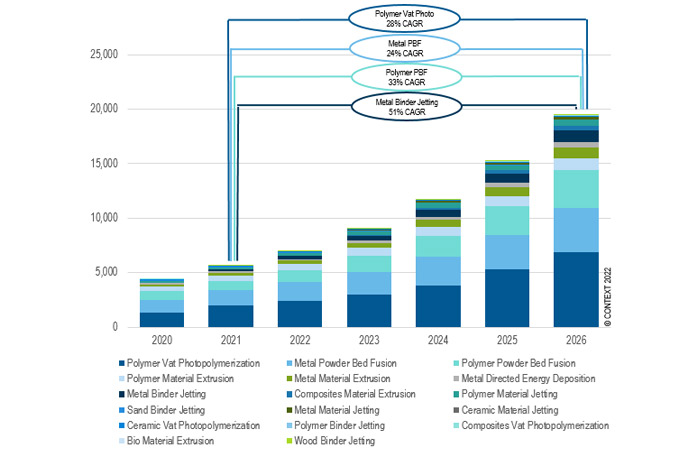

On the industrial 3D printer side, metal binder jetting is seeing the biggest increase in shipments, with Desktop Metal in particular having acquired its competitor ExOne. This increase is quantified at +113% compared to the first quarter of 2021. And it is clear that this market will continue to show interesting statistics – recently Markforged announced the acquisition of Digital Metal, whereas it had previously focused on extrusion solutions. HP’s Metal Jet Fusion process, which is expected to hit the market soon, is also a major contributor to the growth of this segment. More generally, Prodways, BMF, 3D Systems, Farsoon and HP are the companies that are doing well in polymers and Eplus3D, Velo3D, TRUMPF and Farsoon in metals.

Binder jetting shows strong growth compared to other processes (photo credits: CONTEXT)

Two Other Segments are Trailing Behind According to CONTEXT

It seems that printers in the category of professional solutions have seen a slight increase in terms of shipments compared to 2021 – about +2%. The market may have some surprises in store for us, especially following the merger between Ultimaker and Makerbot, two historical players in desktop FDM 3D printing. It will be interesting to see what strategy the two manufacturers will adopt and what synergies they will be able to offer to boost this segment. Formlabs, Raise3D and Sprintray are also among the fastest growing companies.

Finally, those classified as personal 3D printers have seen a significant drop in shipments at 25% less compared to Q1 2021. However, the education sector could participate in the increase in shipments as more and more governments are working to promote additive manufacturing in schools and universities. More than ever, 3D printing needs to be integrated into school curricula and rely on initiatives to promote its accessibility. If you want to know more about the study, go HERE.

*Cover Photo Credits: TRUMPF